Sustainability

& Consumer Behavior

in Fashion

Design Process

DISCOVER

Background Research

Problem Statement

Literature Review

DEFINE

User Survey

User Interviews

DEVELOPE

Qualitative and Quantitative Analysis

Card Sorting

Affinity Mapping

Theme building

DELIVER

Design Recommendations to Stakeholders

Background Research

Why it matters?

“The fashion industry annually requires 79 billion cubic meters of water (about 20% of the world's total water consumption), generates 1.7 billion tons of CO2 (almost 10% of the world's total CO2 emissions), and produces 92 million tons of textile waste” (Centobelli et al.).“On average, 68 pounds of textile products per person go to landfills each year, with additional solid waste coming from packaging, cleaning, and the manufacturing process” (Bhardwaj and Manchiraju).

The fashion industry's impact on sustainability is significant, with vast water consumption and tons of clothing ending up in landfills each year. Emerging trends such as AI, e-commerce, and influencer marketing reshape consumer behavior, posing challenges and opportunities to promote sustainable fashion choices through enhanced awareness and innovative strategies.

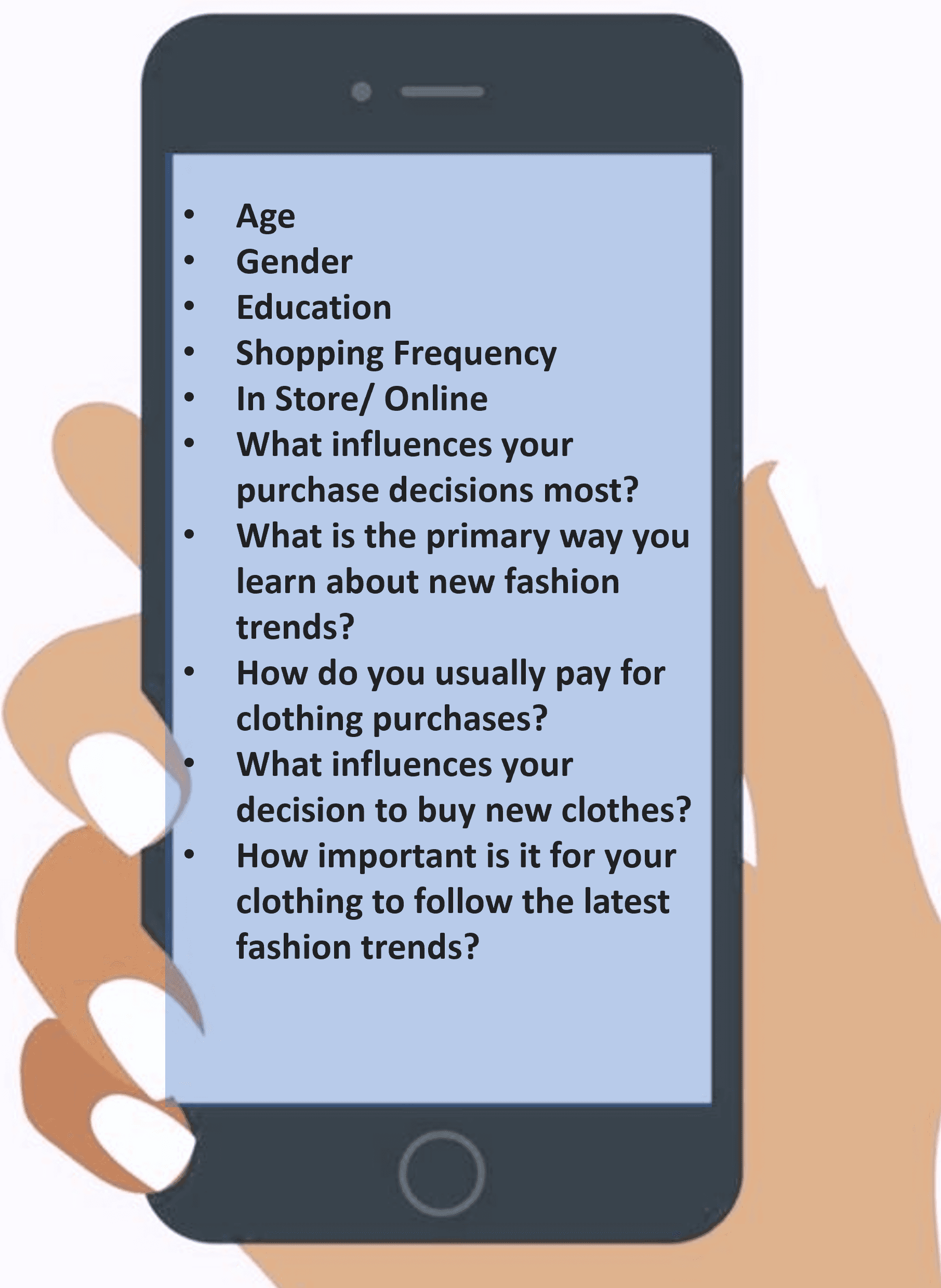

User Surveys

Data Collection Method:

Employed an online survey via Google Forms.

Survey Responses:

Accumulated 83 responses to date.

Distribution Channels:

Shared the survey on platforms including LinkedIn and Reddit, as well as with personal network contacts.

Quantitative Data Analysis

Observations on Age and Purchase Behavior

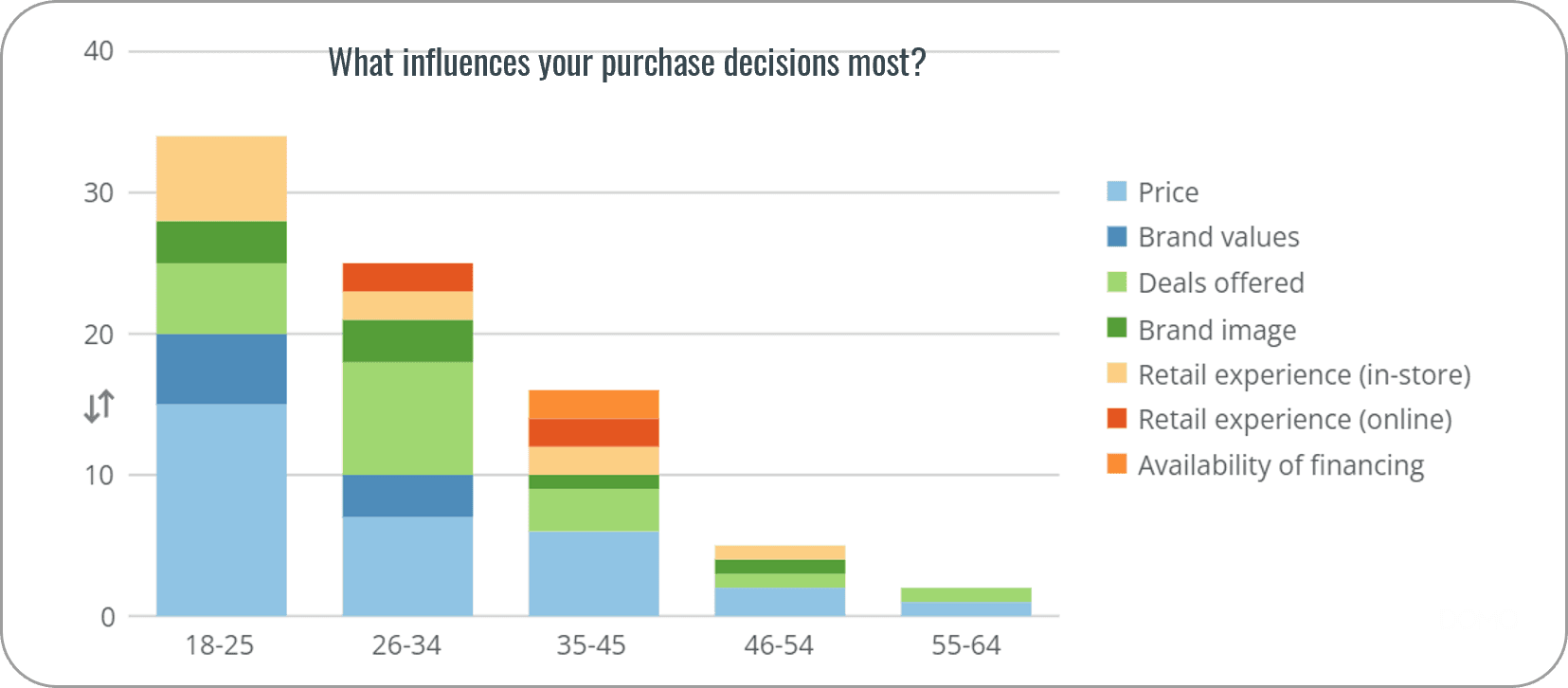

Purchase Decisions

Price and availability of deals are significant factors for all age groups.

Brand values (including sustainability) are important among younger demographics which is at odds with price sensitivity.

It surprised us that the youngest demographic was influenced heavily by the in-store experience.

For ages 26-35, ‘Deals’ are important, perhaps due to budgeting for growing families.

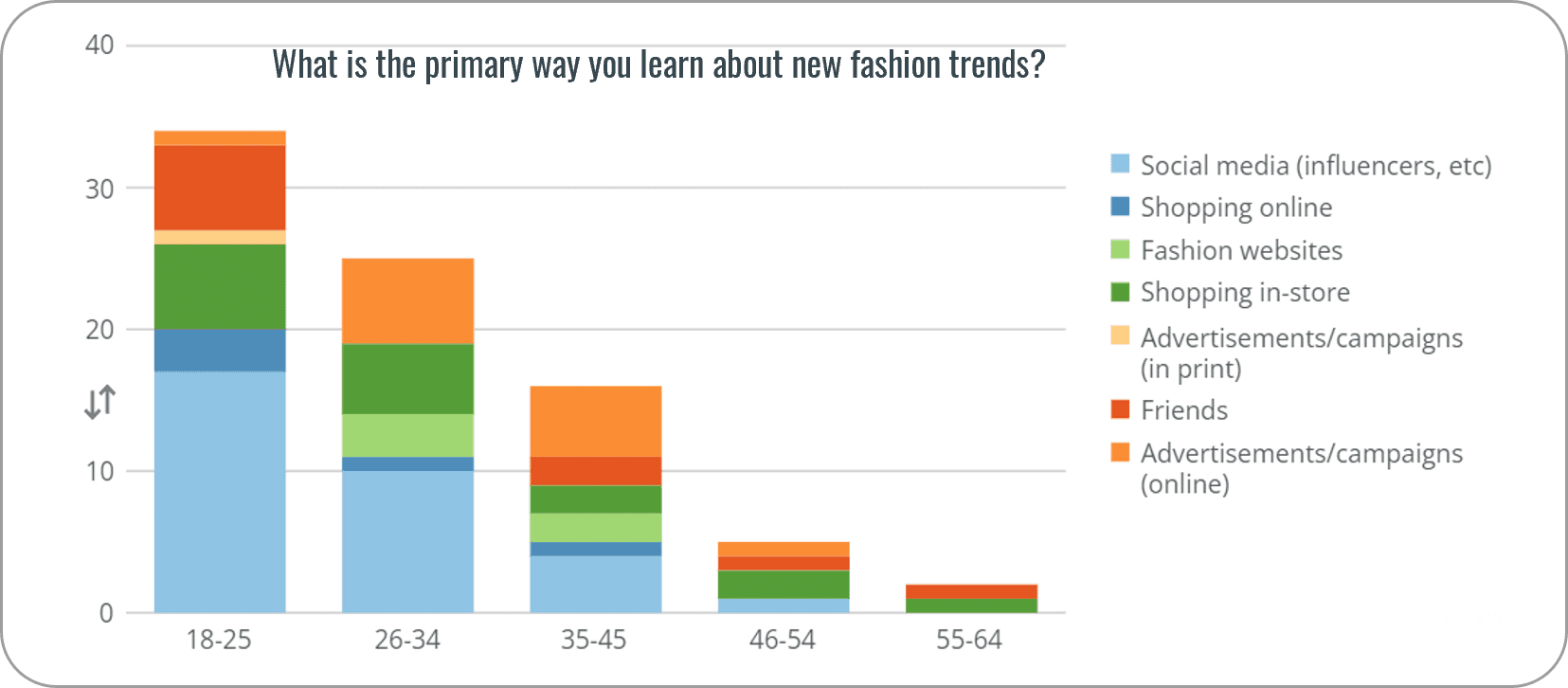

Primary way to learn New Fashion Trends

Social media heavily influences how the 18-34 age groups learn about fashion trends.

Online advertising is most effective for 26-45 age groups.

Again, shopping in-store was more influential in learning about fashion trends amongst the youngest demographic.

Friends seem to influence awareness of fashion trends among the youngest groups the most.

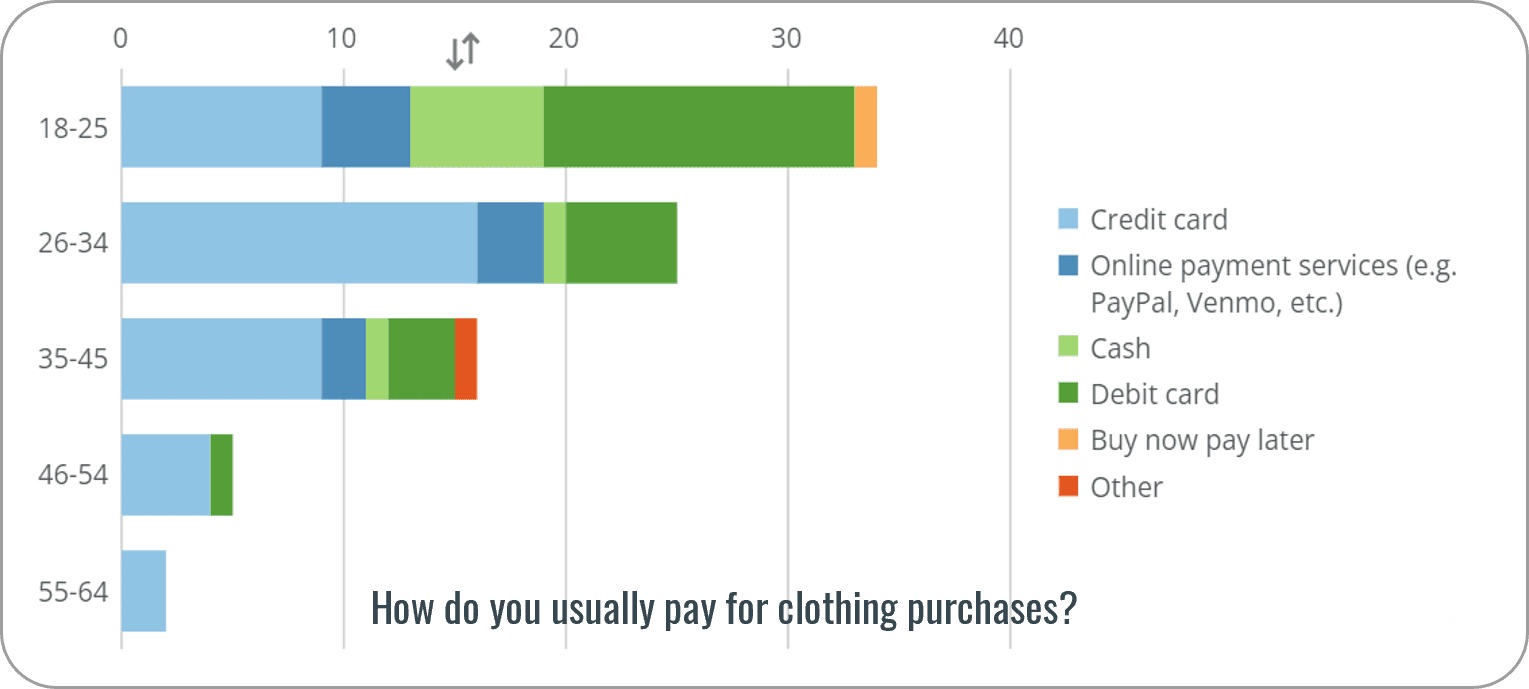

Mode of Payment Preferred

Respondents in the 18-25 range used Debit Card as the major mode of payment, while all other demographics used credit card as the primary mode of payment.

The youngest demographic is open to buy now pay later options.

A surprising observation is that the older you are, the less likely you are to pay with cash.

For all other age groups Credit card is the major mode of payment.

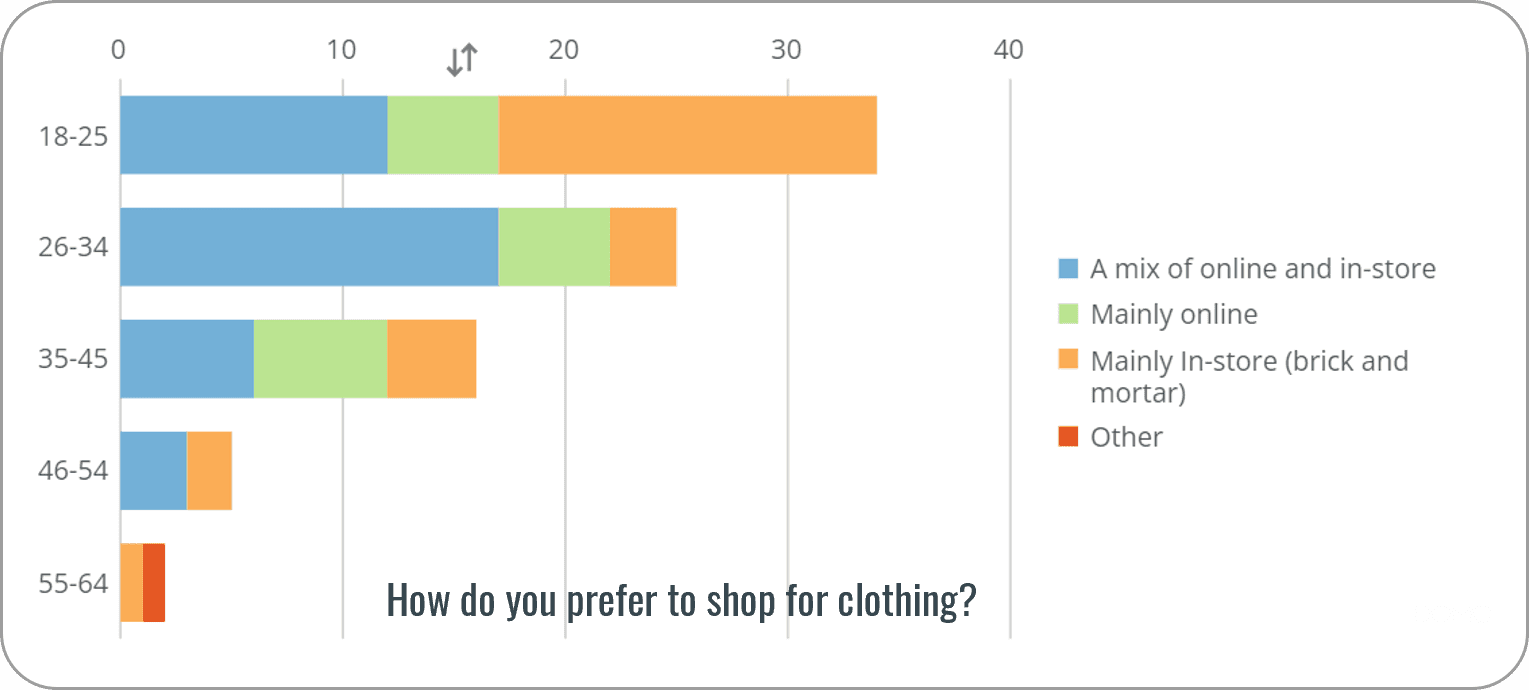

Shopping Preference

Again, in-store shopping was preferred among the youngest demographic.

For participants aged 26 to 34, a mix of online and in-store shopping is the most popular, while mainly in-store shopping received the least responses.

For participants aged 35 to 45, there is an almost equal distribution between mainly online and a mix of online and in-store shopping as the preferred method.

Different age groups have different preferences and choice of shopping.

Observations on Purchase Behavior

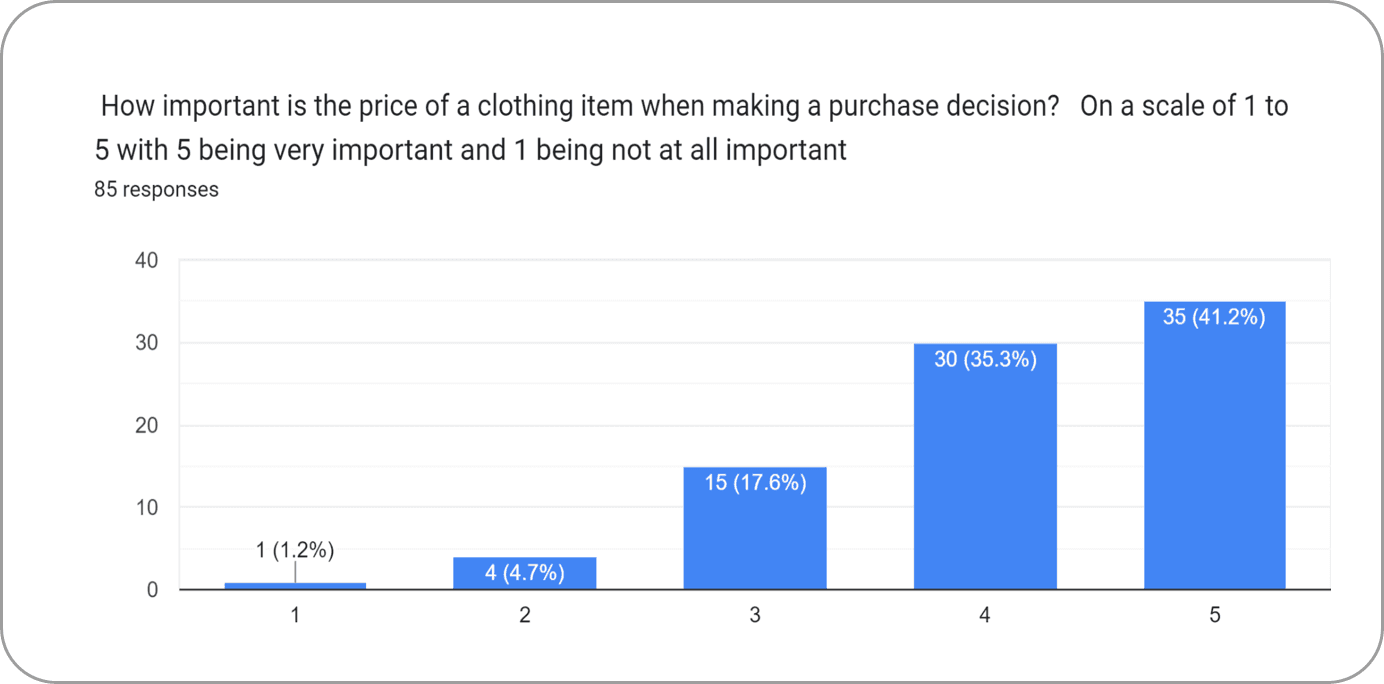

Importance of Price while making a Purchase Decision

The highest number of respondents (41.2%) chose the highest rating of 5, indicating that the price is very important in their purchase decision.

The second highest rating of 4 was selected by 35.3% of the respondents, indicating that the price is still quite important.

Overall, the survey shows that the price of a clothing item is an important factor for most respondents in their purchase decision.

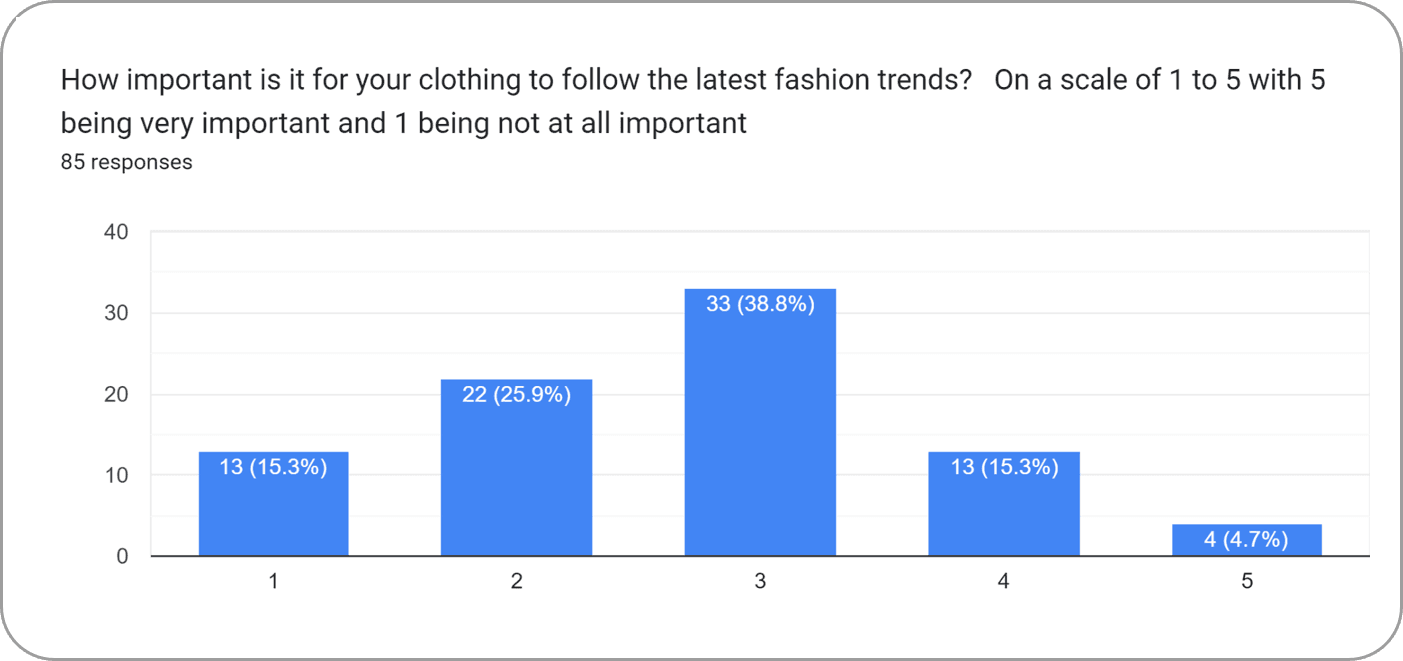

Importance of clothing to follow latest fashion trends

The highest number of respondents (38.8%) chose the highest rating of 3, indicating that the fashion trends are moderately important

The second highest rating of 3 was selected by 25.9% of the respondents, indicating that the latest fashion is not very important.

Overall, the survey shows that the latest fashion trends of clothing is not so important factor for most respondents in their purchase decision.

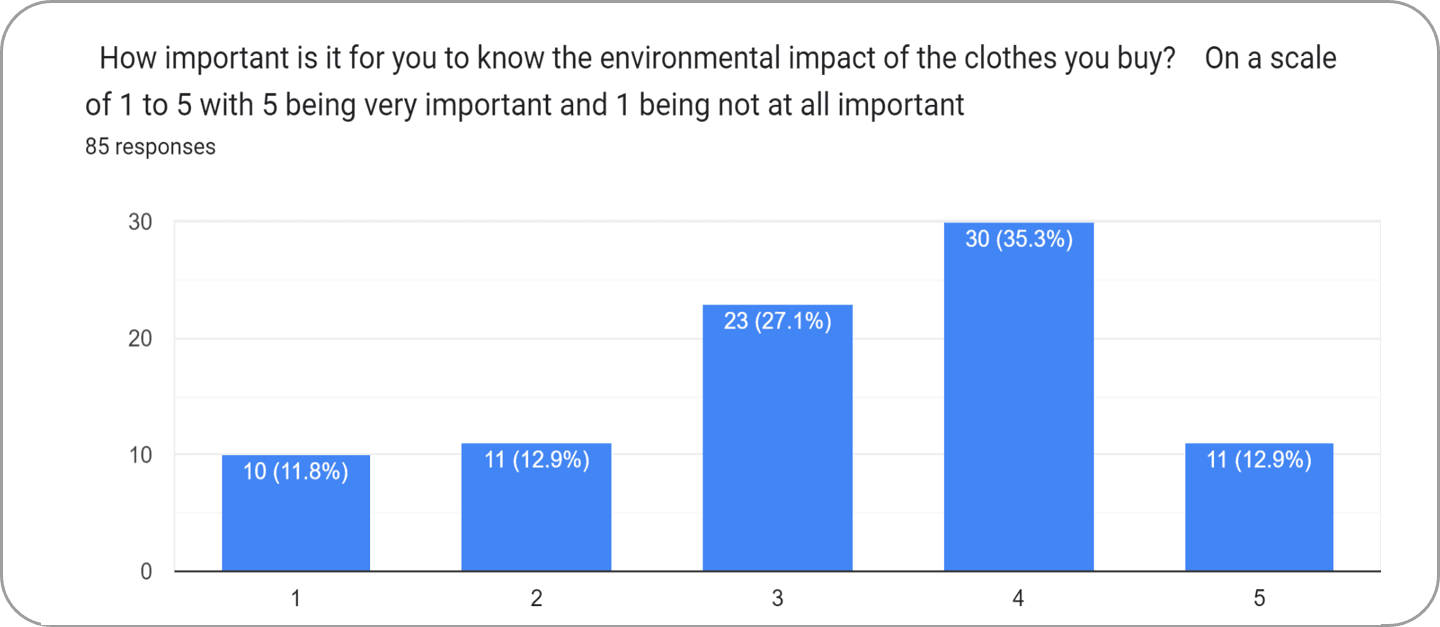

Observations on Sustainability

Most shoppers shop monthly or seasonally.

Monthly shoppers prioritize quality and trendiness.

Seasonal shoppers prioritize high quality and low cost.

This data could suggest that the less frequently someone shops, the more likely they are to cite sustainability as an influence on purchase decision for this data set.

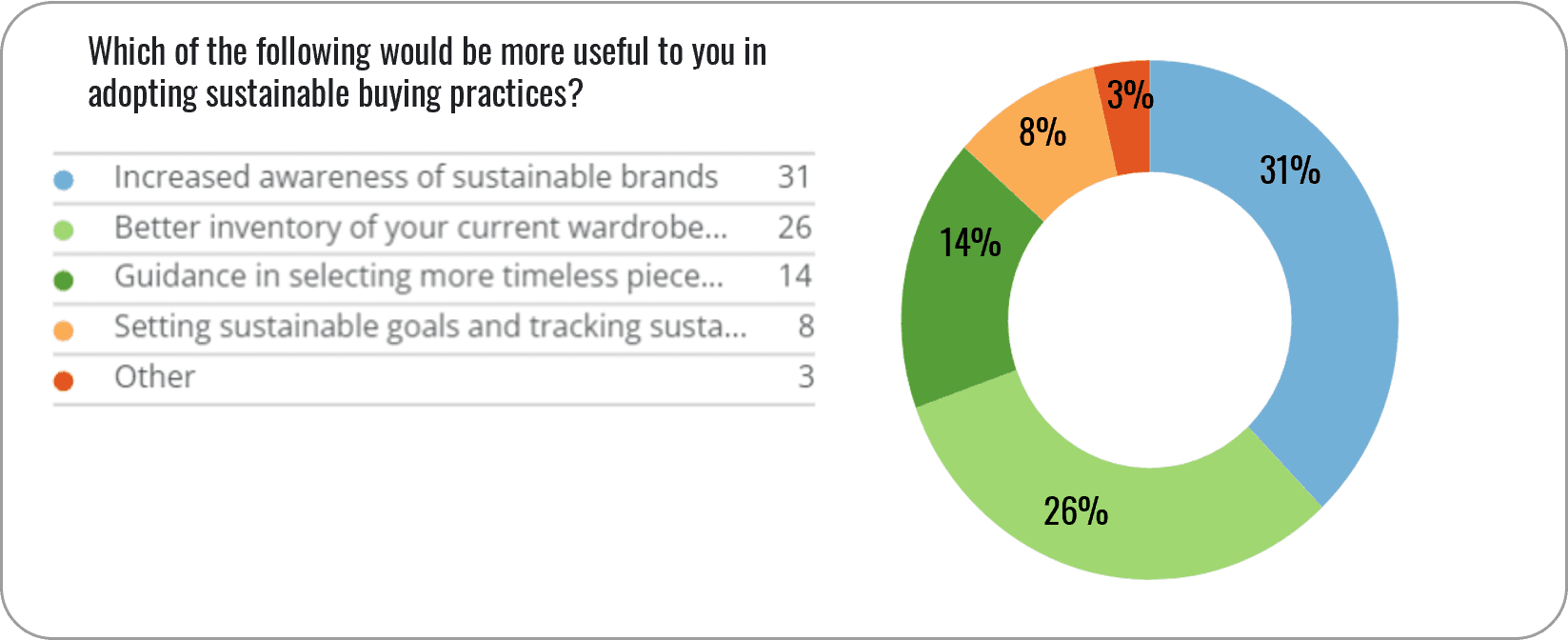

Cost is a primary decider between sustainable and non-sustainable.

Increased awareness of sustainable brands was the most useful factor, this suggest that consumers were interested in purchasing from sustainable brands, but may not have enough information to do so effectively.

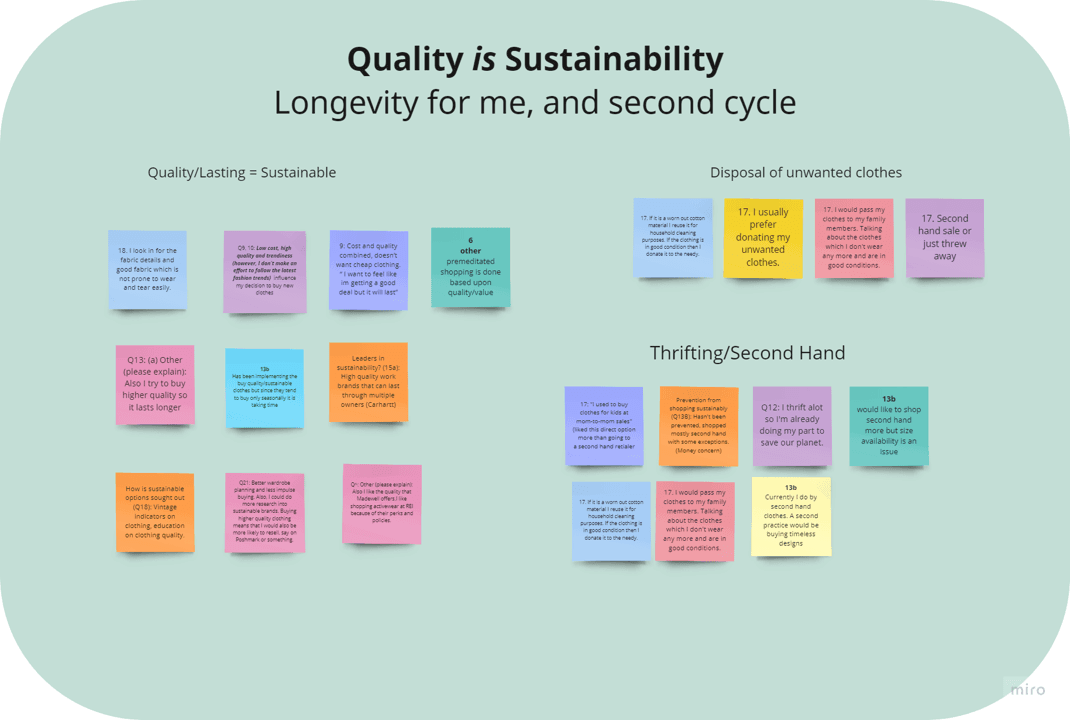

Better inventory of current wardrobe was the second most popular response, suggesting interest in minimalist and sustainable wardrobe.

Overall, the findings suggest that there is a growing awareness and interest in sustainability among consumers, but more education and information may be needed to support sustainable purchasing habits.

A considerable proportion of respondents value knowledge of environmental impact on clothing and also cite knowledge of sustainable brands as being of value in making purchase decisions.

There is a need for more awareness-raising initiatives to increase consumer awareness of the environmental impact of clothes.

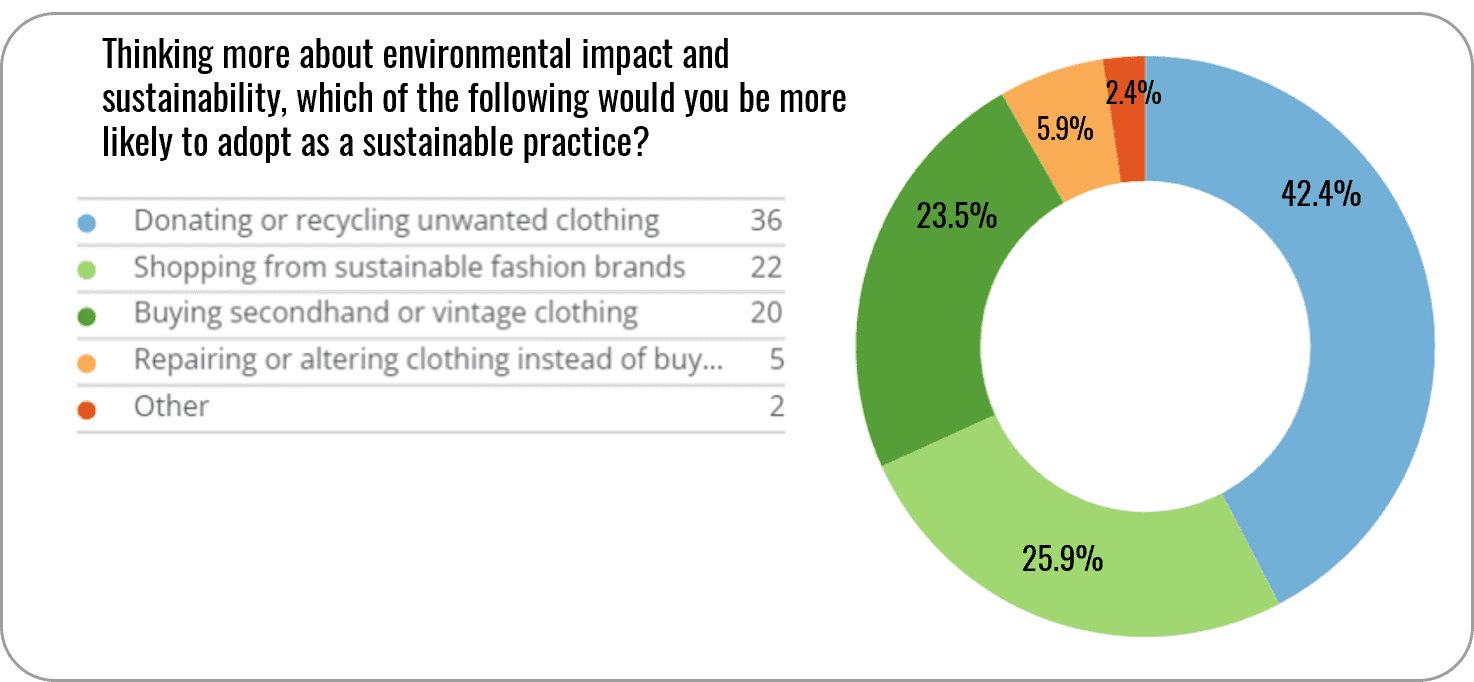

Most respondents cite donating or recycling unwanted clothing as the most likely sustainable practice which did not come as surprise.

Many respondents chose the option of purchasing from a sustainable brand as second which could be capitalized on again by brands creating awareness initiatives.

User Interviews

Participant Recruitment: Employed a rigorous process for recruiting participants, ensuring a representative sample with diverse perspectives and backgrounds.

Total Interviews: Conducted a total of 13 comprehensive interviews.

Duration: Each interview session averaged around 30 minutes.

Interview Allocation: Interviews were distributed among team members for workload balance and diverse participant perspectives.

Insights: Structured questions led to unexpectedly detailed participant responses, enriching the data.

Interview Questions

Qualitative Data Analysis

Data Management: Transfer interview content into Google sheets to collect all interview data in one place

Data Analysis: Extract qualitative content into Miro so we can collaboratively:

Discuss

Discuss/highlight insights as a team and share interesting observations from our interviews.

Sort

Begin a rough sorting or clustering into broad categories to better process insights.

Develop

Identify interesting patterns and start to develop themes from qualitative data.

Qualitative Feedback from Interviews

Initial Clustering

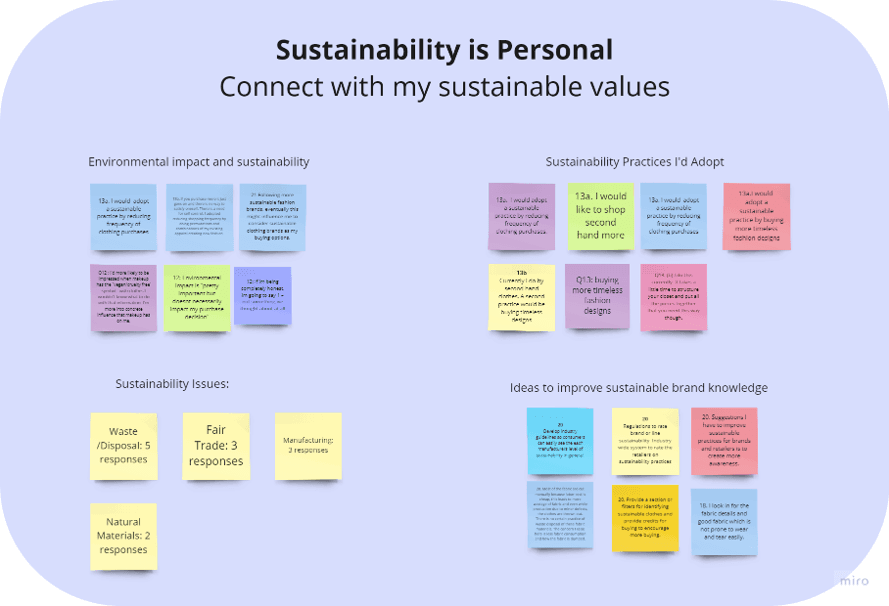

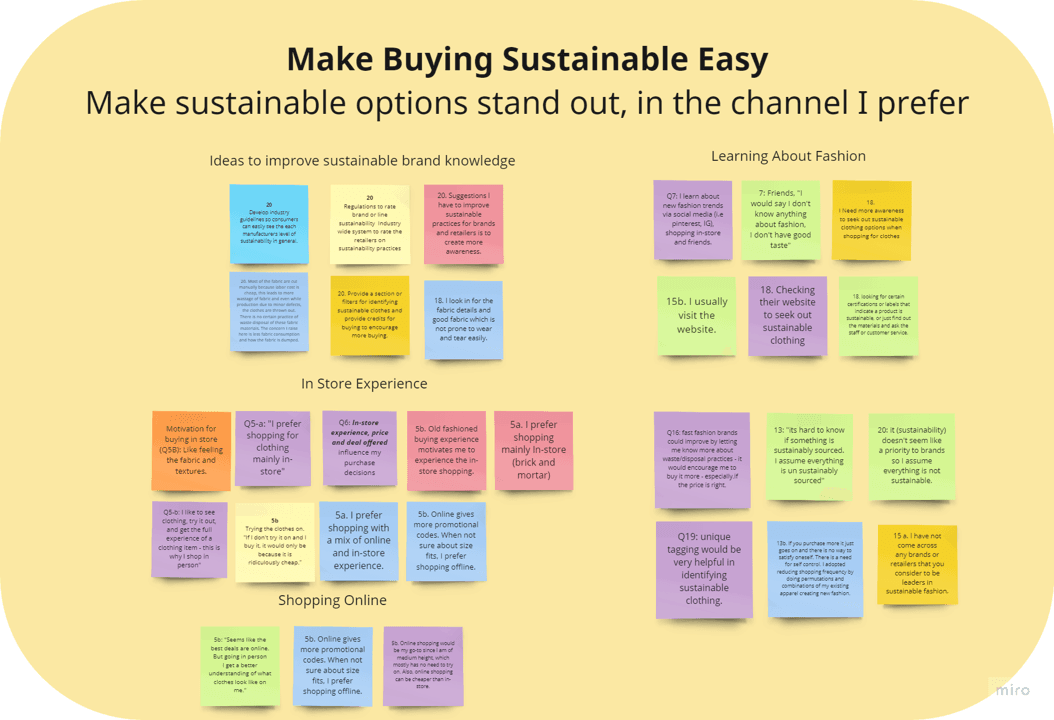

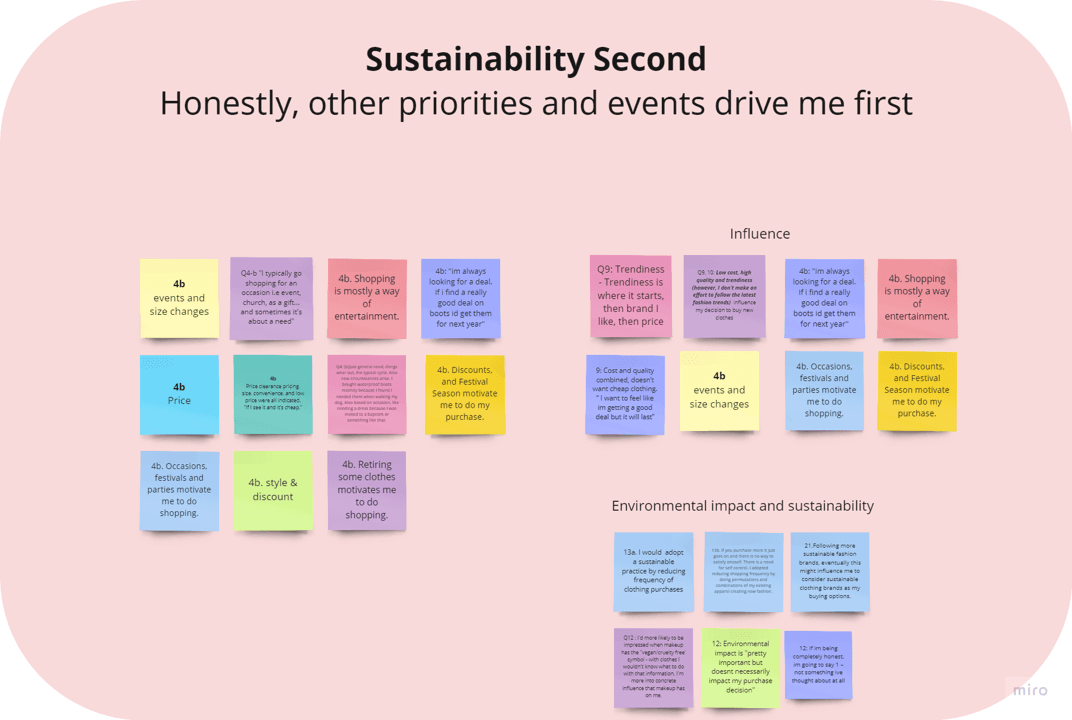

Theme Development

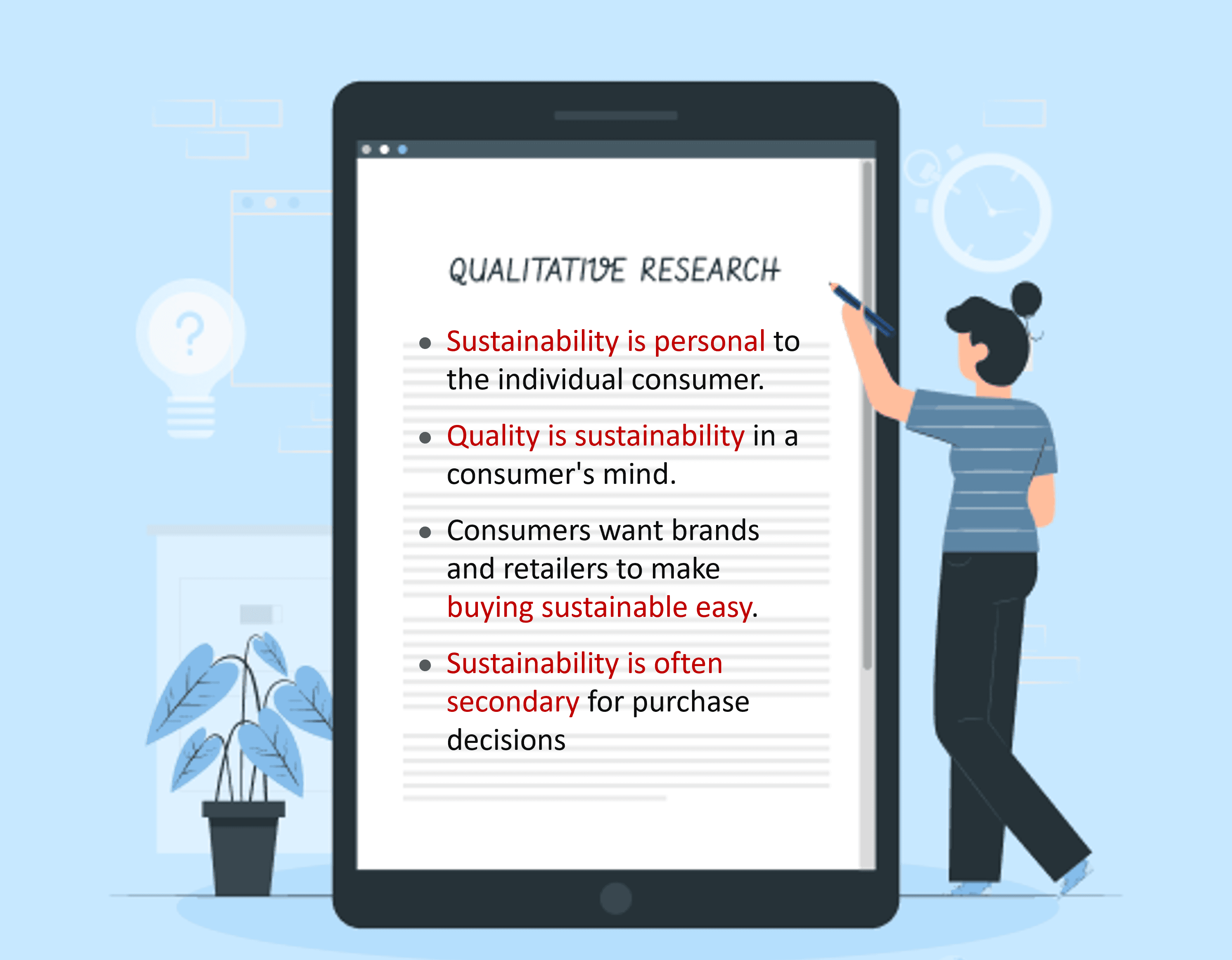

Research Findings

Price & Deals Influence: Price and deal availability strongly impact purchase decisions across all age groups.

Age-Dependent Trend Learning: The engagement with fashion trend learning significantly varies among age groups.

Youthful In-Store Preference: In-store shopping remains highly relevant, especially among the youngest demographic.

Sustainability Awareness: Increased awareness of sustainable brands and knowledge of one's wardrobe can positively impact sustainable purchase decisions.

Personalized Sustainability: Sustainability is a deeply personal concept for individual consumers.

Quality Equals Sustainability: Consumers often equate quality with sustainability in their perceptions.

Demand for Convenience: Consumers desire brands and retailers to simplify the process of making sustainable choices.

Sustainability as a Secondary Factor: Sustainability, while important, often takes a back seat in driving consumer purchase decisions.

Key Takeaways

Impact

Tripshare succeeded in creating a platform that:

Enhanced Brand Communication

Brands adopted transparency strategies to build trust and align with consumer values.

Improved Consumer Awareness

Recommendations for awareness campaigns and app features made it easier for consumers to choose sustainable options.

Support for Development of App

Provided a framework for apps to include features that guide users toward sustainable fashion choices, bridging the gap between intention and action.

Reflection

What I Learned

This project reinforced the importance of understanding user psychology and behavior in creating effective, sustainable solutions. It also highlighted the need for ongoing consumer education and transparent brand practices in shaping sustainable consumer habits.

Next Steps

The project’s insights can be leveraged to explore ongoing trends in sustainable behavior and test the efficacy of new app features or awareness campaigns.